what is the percentage of taxes taken out of a paycheck in colorado

For the first 20 pay periods therefore the total FICA tax withholding is equal to or. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total.

Virginia Tax Rates Rankings Virginia State Taxes Tax Foundation

Colorado Unemployment Insurance is complex.

. Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. Total income taxes paid. How Your Colorado Paycheck Works.

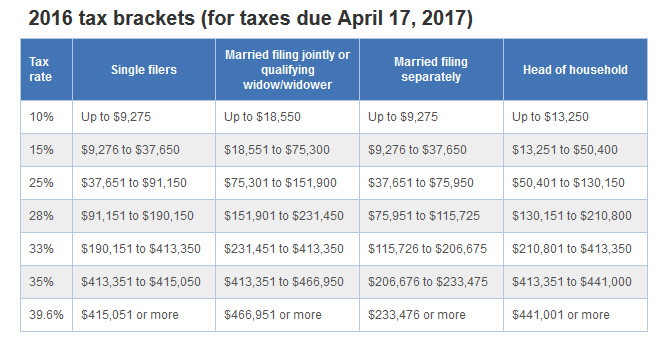

These taxes go to the IRS to pay for your federal income. Total income taxes paid. You pay the tax on only the first 147000 of your.

FICA taxes consist of Social Security and. Since 142800 divided by 6885 is 207 this threshold is reached after the 21st paycheck. Both employee and employer shares in paying these taxes.

Just enter the wages tax withholdings and other information required. The employer portion is 15 percent and the. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b.

If you are a Colorado resident your employer will withhold taxes from every paycheck you get. Use ADPs Colorado Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. The federal government requires that you pay 62 percent of your gross pay for FICA taxes and one-half of your Medicare taxes.

What percentage of taxes are taken out of payroll. It changes on a yearly basis and is dependent on many things including wage and industry. And if youre in the construction.

What is the percentage that is taken out of a paycheck. A total of 153 124 for social security and 29 for Medicare is applied to an employees gross compensation. Calculate your Colorado net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state.

Amount taken out of an average biweekly paycheck. FICA taxes are commonly called the payroll tax. However they dont include all taxes related to payroll.

So the tax year 2022 will start from July 01 2021 to June 30 2022. FICA taxes consist of Social Security and Medicare taxes. The Colorado bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. Colorado Salary Paycheck Calculator. Calculating your Colorado state income tax is similar to the steps we listed on our Federal paycheck calculator.

The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. These are contributions that you make before any taxes are withheld from your paycheck. The current rate for.

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Individual Income Tax Colorado General Assembly

Reciprocal Agreements By State What Is Tax Reciprocity

2022 Federal State Payroll Tax Rates For Employers

Maryland Tax Rates Rankings Maryland State Taxes Tax Foundation

How Do State And Local Individual Income Taxes Work Tax Policy Center

What Is A Payroll Tax Payroll Taxes Medical Debt Small Business Accounting

Colorado Paycheck Calculator Smartasset

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Individual Income Tax Colorado General Assembly

Maryland Tax Rates Rankings Maryland State Taxes Tax Foundation

The Income Tax Rate In Colorado Is 4 63 This Is Not The Only Tax You Will Pay On Your Earnings

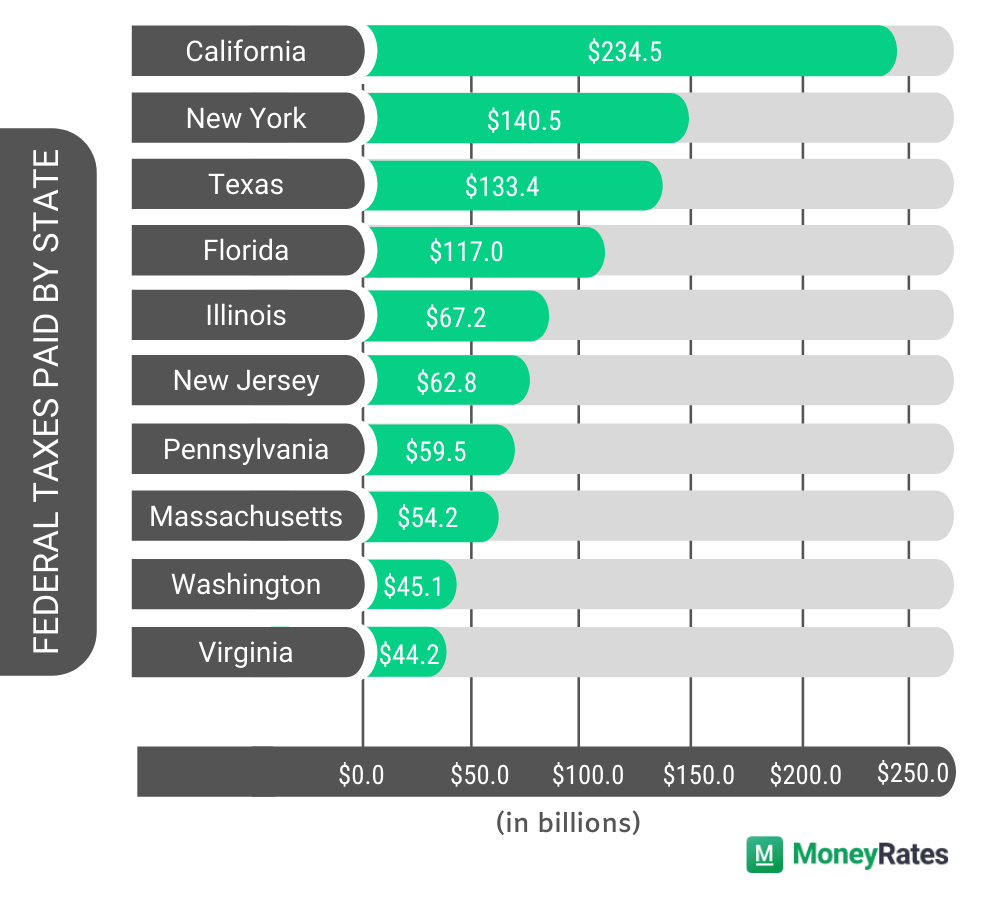

Which States Pay The Most Federal Taxes Moneyrates

![]()

Colorado Paycheck Calculator 2022 With Income Tax Brackets Investomatica

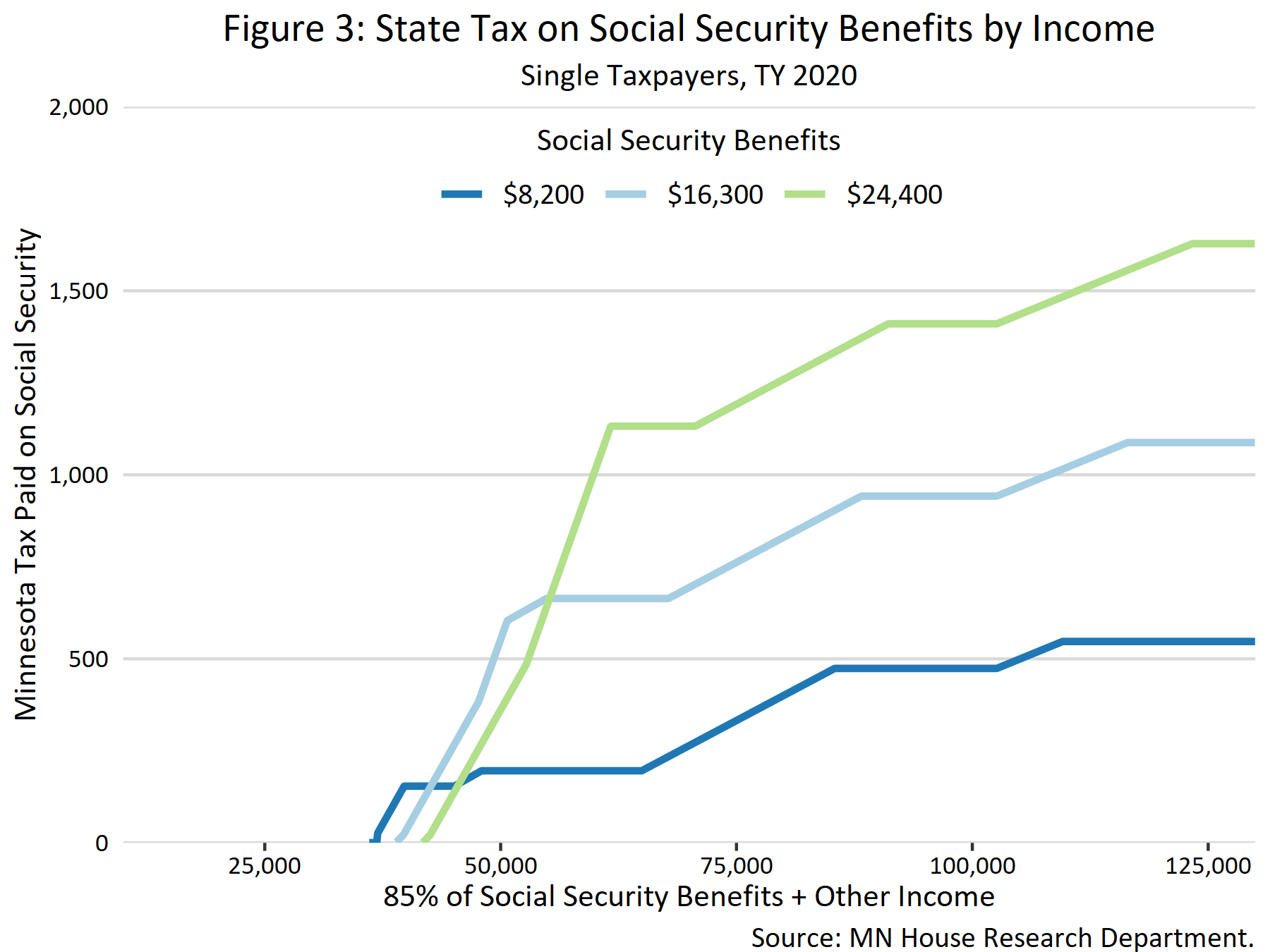

Taxation Of Social Security Benefits Mn House Research

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

How Do State And Local Individual Income Taxes Work Tax Policy Center

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Colorado State Income Tax Rate Reduction Initiative 2022 Ballotpedia